2024 Schedule C Deductions Chart – What are other expenses on Schedule C? Expenses other than those deducted elsewhere on Schedule C (Line 27a) “Include all ordinary and necessary business expenses not otherwise deducted from Schedule . Most soldiers were already on this pay schedule. The change and to access pay charts, pay calculators and more. Make sure to log in and update your Newsletter Subscriptions on Military.com .

2024 Schedule C Deductions Chart

Source : www.irs.govWhen To Expect My Tax Refund? IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.comFree Tax Calculators & Money Saving Tools 2023 2024 | TurboTax

Source : turbotax.intuit.comBusiness tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.comHow To Claim Mileage on Taxes in Five Easy Steps

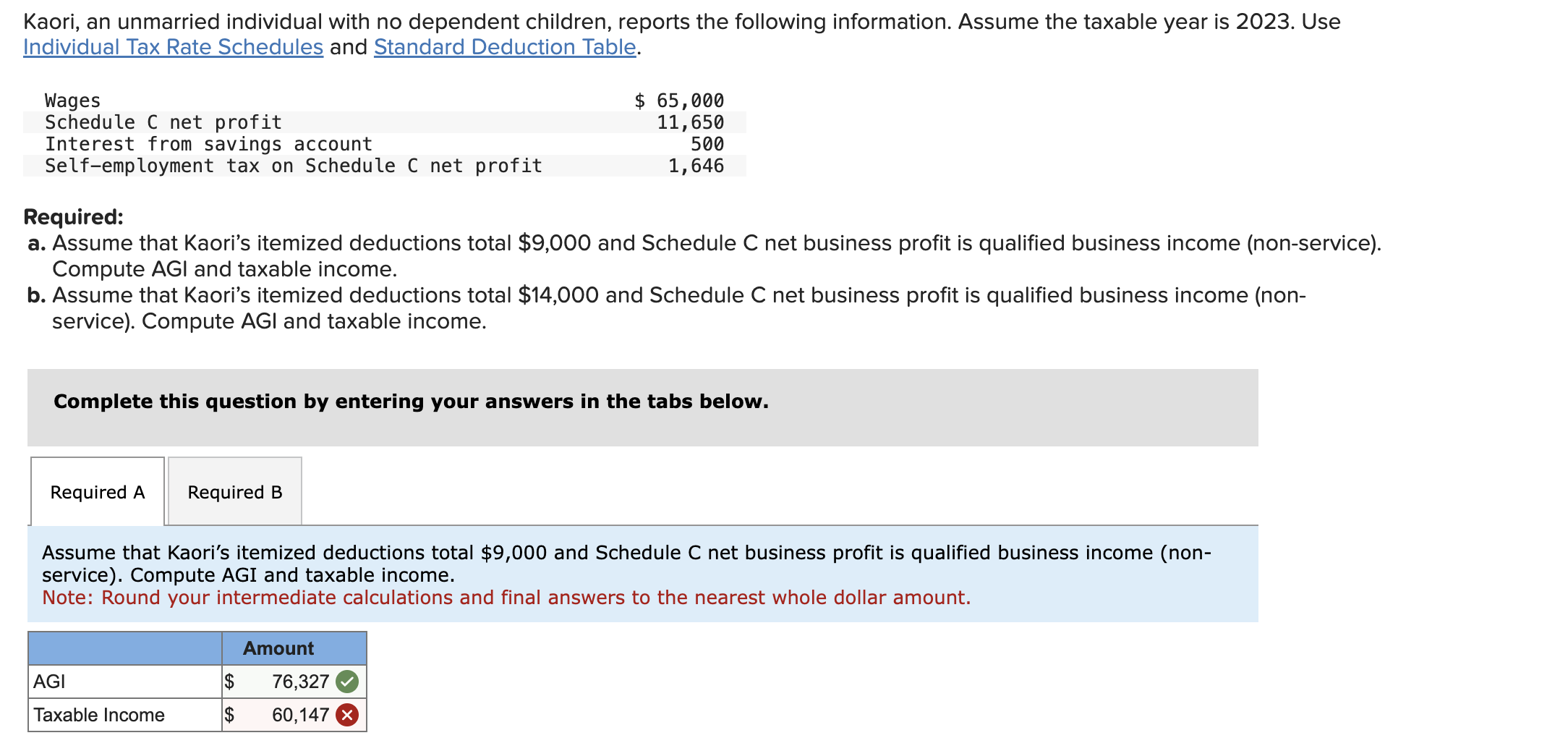

Source : www.driversnote.comSolved Kaori, an unmarried individual with no dependent | Chegg.com

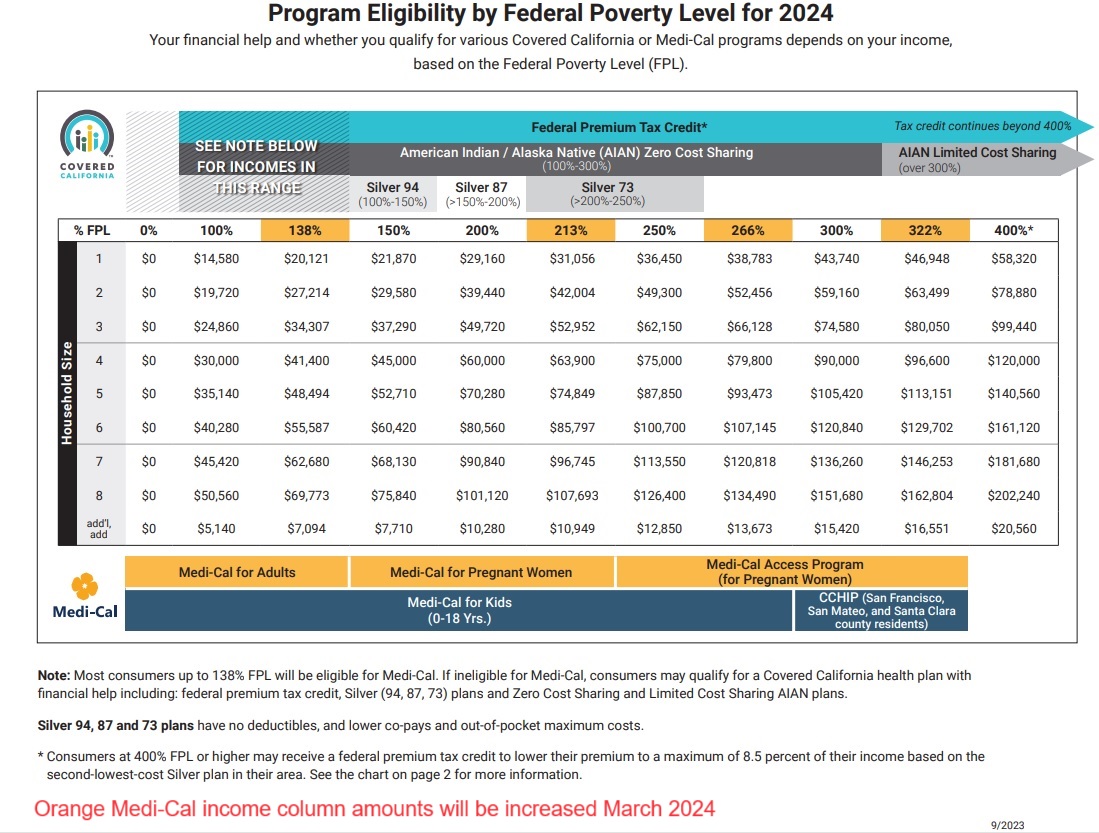

Source : www.chegg.comCovered California Income Tables IMK

Source : insuremekevin.comThe Ultimate 2024 Tax Deductions Checklist for Insurance Agents

Source : blog.newhorizonsmktg.comTax advice for clients who day trade stocks Journal of Accountancy

Source : www.journalofaccountancy.comWhat Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.com2024 Schedule C Deductions Chart Publication 505 (2023), Tax Withholding and Estimated Tax : The expense account can be created within the Chart of Accounts For example, if you file a Schedule C form, select “Sch C: Gross Receipts or Sales Tax Line.” Avery Martin holds a Bachelor . Jeffrey “The Buckinghammer” Levine of Buckingham Wealth Partners answers a reader’s question about when it’s necessary to file a Schedule C. In this Ask the Hammer, a reader who plans to build an .

]]>