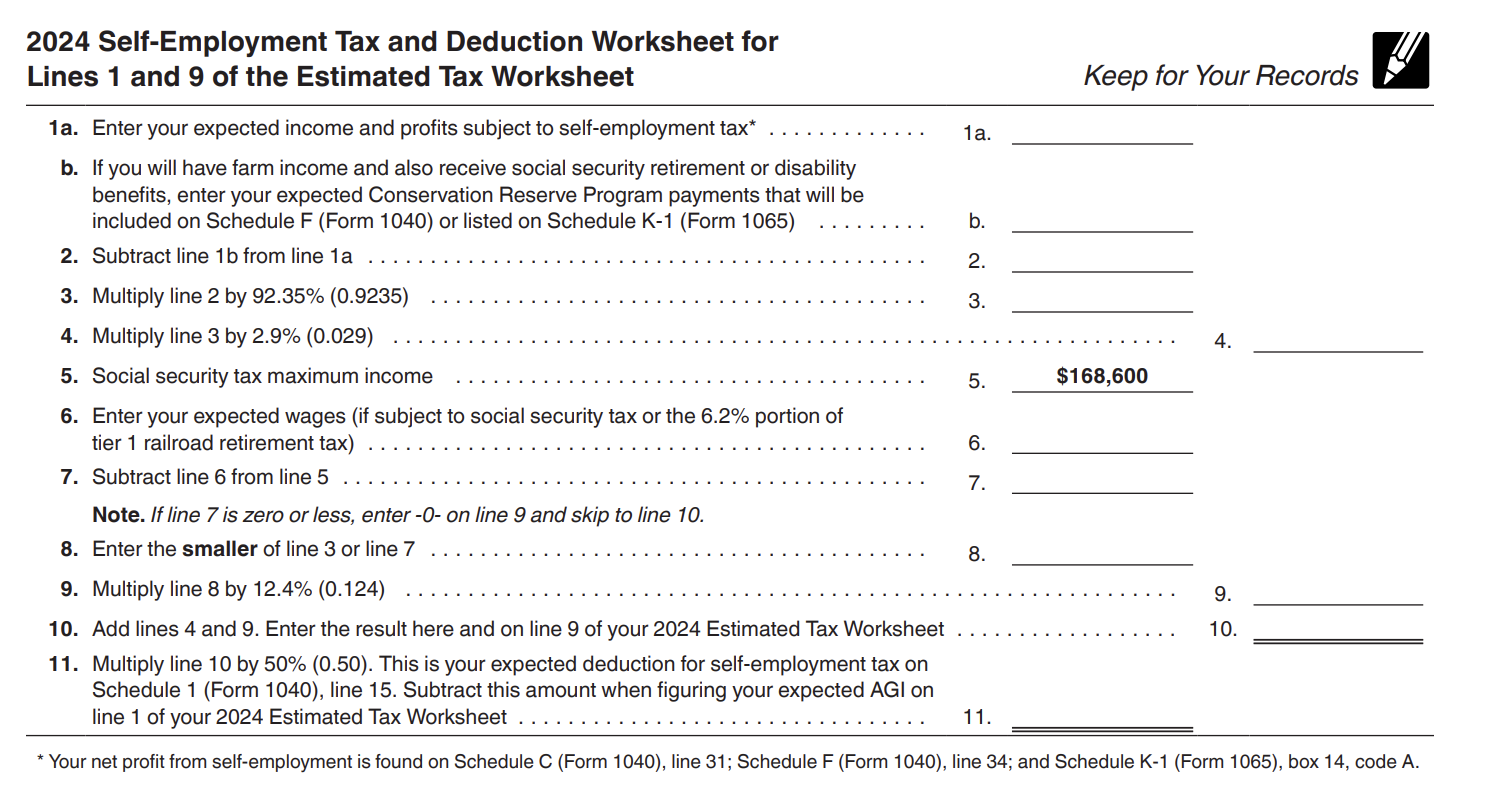

2024 Schedule C Deductions Calculator – She has been instrumental in tax product reviews and online tax calculators to including Schedule SE for self-employment taxes and Schedule C to report business profit or loss from a sole . Income tax deductions are an essential and legitimate “At a minimum, you want the categories that are listed on the Schedule C, Form 1120 or [Form] 1065. For your internal tracking, you .

2024 Schedule C Deductions Calculator

Source : turbotax.intuit.comWhen To Expect My Tax Refund? IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.comYear End Tax Planning 2023 2024 | Crowe BGK

Source : www.crowe.comUs Budget: Over 30,783 Royalty Free Licensable Stock Photos

Source : www.shutterstock.comHow To Claim Mileage on Taxes in Five Easy Steps

Source : www.driversnote.comUS Crypto Tax Guide 2024 | Koinly

Source : koinly.ioWhat to Know About 2024 Tax Withholding and Estimated Taxes WSJ

Source : www.wsj.comEstimated Taxes, Due Dates and Safe Harbor Tax Rules (2024)

Source : wallethacks.comHow much should I budget for medical expenses with my 2024 HSA

Source : hsastore.comIRS Refund Pay Schedule 2024 Federal Tax Refund Release Date

Source : ncblpc.org2024 Schedule C Deductions Calculator Free Tax Calculators & Money Saving Tools 2023 2024 | TurboTax : Investing in a solo 401(k) is a common retirement savings plan for self-employed individuals or small business owners. Let’s break down how it works, gets taxed and what potential deductions you can . While the standard deduction nearly doubled and the child can deduct many of these items as business expenses on Schedule C. That means people who work in the gig economy or perform freelance .

]]>